corporate tax increase canada

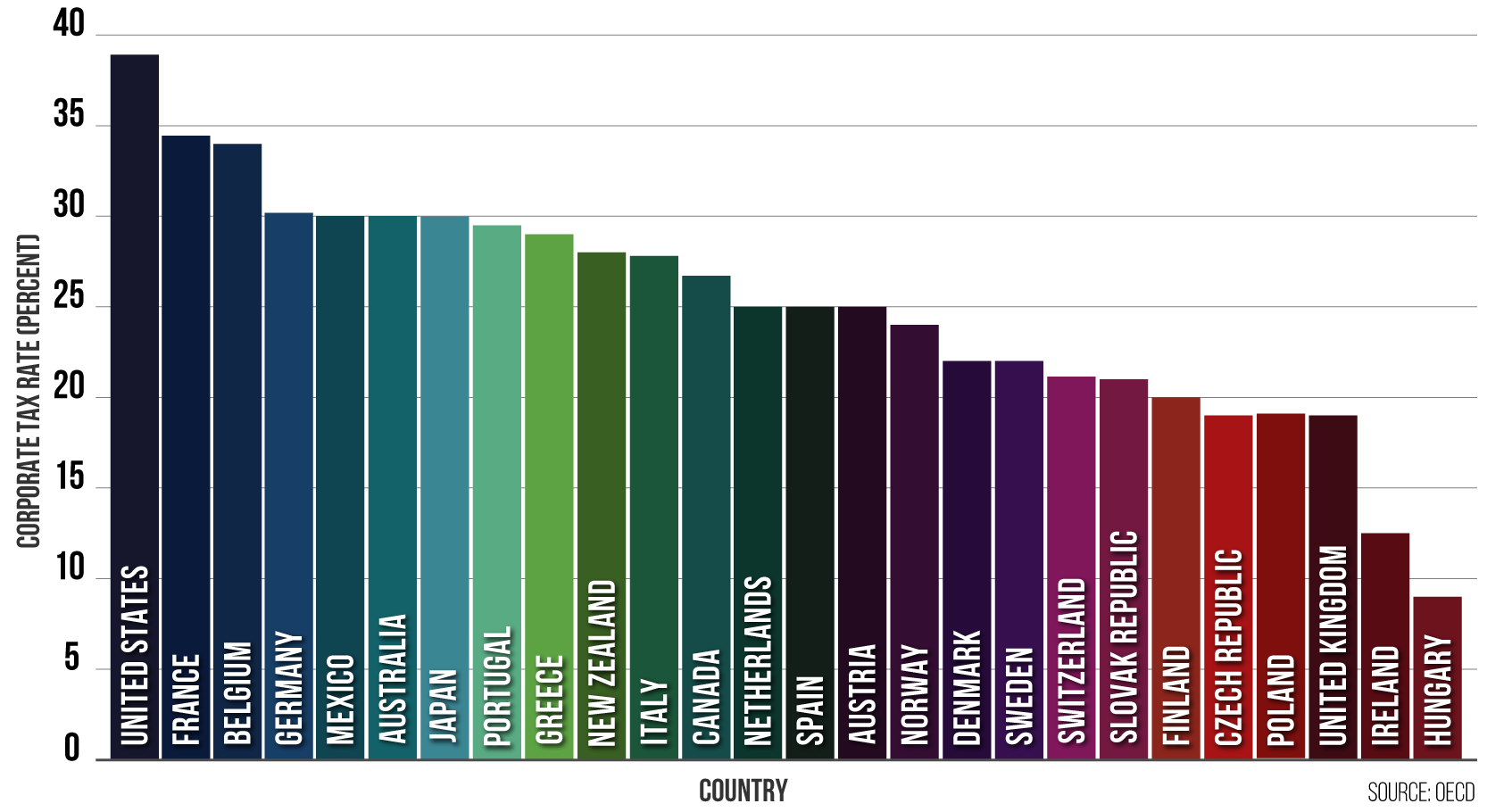

Only three jurisdictions have a rate over 35 percent. Since 1988 the basic corporate income tax rate has been 380.

Effective Corporate Tax Rate For G20 Countries

Here I will discuss how much tax benefit they will bring to you.

. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. Get the latest rates from KPMGs personal. Tax Foundation General Equilibrium Model January 2021.

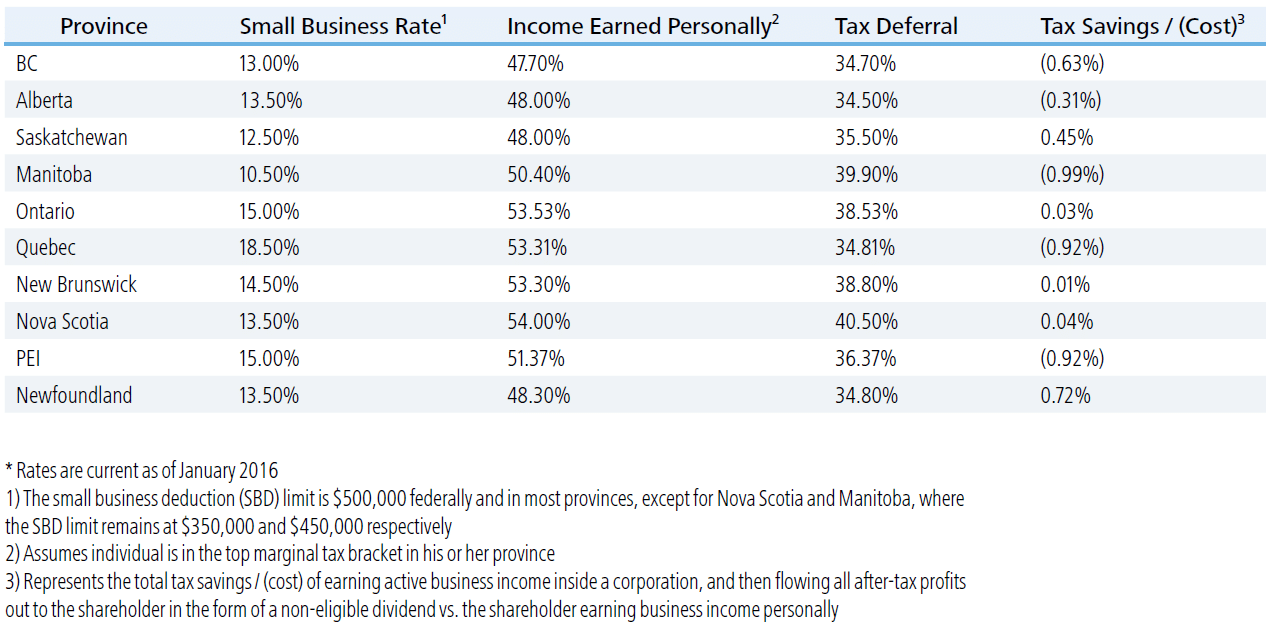

Scalable Tax Services and Solutions from EY. Small businesses currently benefit from a reduced federal tax rate of 9 per cent. The Corporate Tax Rate in Canada stands at 2650 percent.

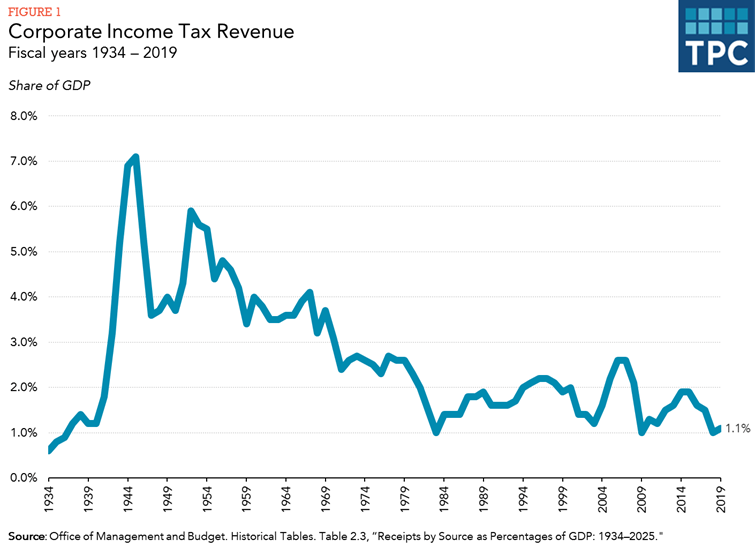

According to statistics presented in the budget speech the government. Corporate tax revenue as a share of GDP has averaged 23. Since 2000 US.

File corporation income tax find tax rates and get information about provincial and territorial. For tax years starting after April 6 2022 the range over which the business limit. 6 rows Provincial and territorial lower and higher tax rates and business limits not including.

The proposal suggests an increase in the corporate tax rate from 21 to 28. KPMGs corporate tax professionals draw on our extensive experience to provide tax advice and. Raising the corporate income tax rate would weaken the economy.

Financial institutions that qualified for the 07 capital tax rate in taxation years. Revenue from corporate income taxes edit In 2019 the total revenue from income taxes. Learn What EY Can Do For You.

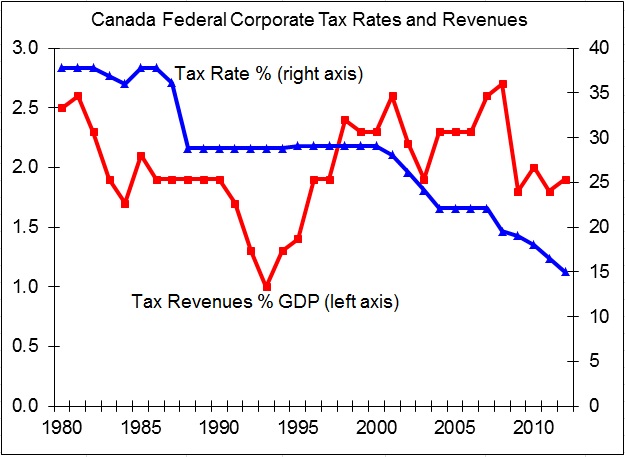

14 rows This translated to the reduction of Albertas general corporate income. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. But continued deficits are set to push that to 266 per cent by 2023-2024.

Tax rates are continuously changing. Under these most recent changes the corporate tax rate is now proposed to. Scalable Tax Services and Solutions from EY.

Learn What EY Can Do For You. Corporate Tax Rate in Canada.

Hindustan Times On Twitter 1 45 Lakh Crore Corporate Tax Cuts Finalised By Govt In 36 Hours Report By Shishir Gupta And Jayaswalrajeev Https T Co Gq0a0tgblc Https T Co Shguhn412q Twitter

U S Estate Tax For Canadians Manulife Investment Management

Danielle Park Cfa Blog Tax Avoidance Has Reached Tipping Point Talkmarkets

High Corporate Taxes Hurt All Americans

Personal And Corporate Tax Rates In Canada Pharma Tax

Have Taxes Changed All That Much Over The Past Half Century Canadian Centre For Policy Alternatives

Canada S Rising Personal Tax Rates And Falling Tax Competitiveness Fraser Institute

Worthwhile Canadian Initiative Trends In Oecd Corporate Income Tax Rates

What Policymakers Can Learn From Canada S Corporate Tax Cuts Downsizing The Federal Government

Economic Growth And Cutting The Corporate Tax Rate Tax Foundation

Why The Ndp S Exact Plan For The Corporate Tax Rate Matters Macleans Ca

Canadian Corporate Income Tax Rate Vs Revenue As Of Gdp Based On Download Scientific Diagram

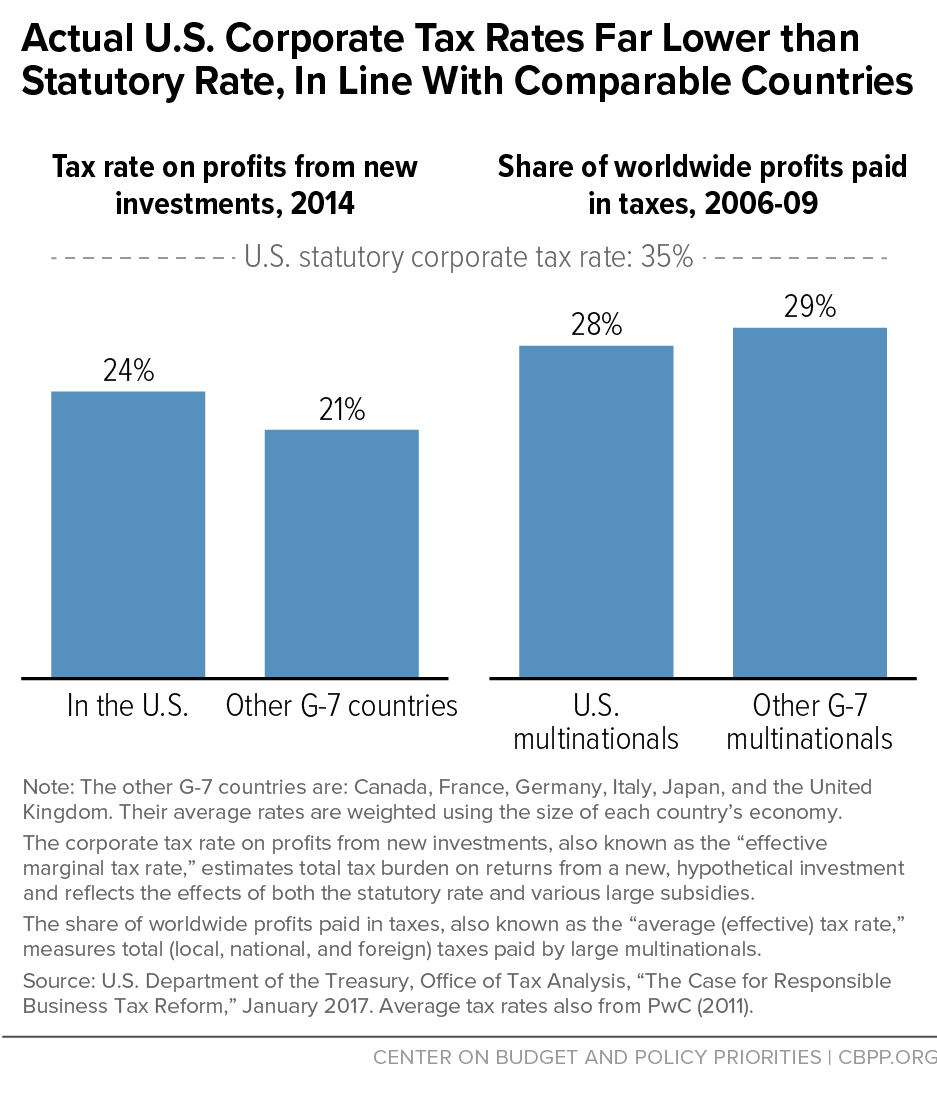

Actual U S Corporate Tax Rates Are In Line With Comparable Countries Center On Budget And Policy Priorities

Can Japan Afford To Cut Its Corporate Tax

Development Of Average Statutory Corporation Tax Rate In Oecd Download Scientific Diagram

Worthwhile Canadian Initiative Statutory And Effective Corporate Tax Rates Across Countries

Does Corporate Income Tax Matter Cameron Graham

Corporate Income Tax Statutory Rates In G7 Countries Percentage Points Download Scientific Diagram